Tokio Marine & Nichido, NTT DATA, STANDAGE and TradeWaltz Jointly Conducted a Demonstration Experiment for a New Trade Settlement System

Tokio Marine & Nichido Fire Insurance Co., Ltd. (President: Shinichi Hirose, hereinafter reffered to as “Tokio Marine & Nichido”), NTT DATA Corporation (President and Chief Executive Officer: Yo Honma, “NTT DATA”), STANDAGE Inc. (President and Chief Executive Officer: Akinori Adachi, “STANDAGE”) and TradeWaltz Inc. (President and Chief Executive Officer: Hirohisa Kojima, “TradeWaltz”) jointly conducted a demonstration experiment to establish a new trade settlement system.

Taking full advantage of the results, the four companies aim to jointly create the world’s first system, by the end of fiscal year 2023, in which electronic B/Ls (bills of lading) and digital currencies (or crypto assets) are exchanged simultenaously ensuring safe and secure trades.

1. Background

In a trade transaction, a payment is exchanged with B/L (* 1), a document of title representing the property of the cargo. However, due to a geographical distance between exporters and importers, they cannot directly exchange payments for B/Ls, which creates the risk of default and requires the cost of hedging risks through banking, insurance, factoring and so forth.

Recently, there has been a growing movement in Japan to revise laws in order to legally acknowledge electronic B/Ls, and many countries are considering the establishment of laws for electronic B/Ls.

There also have been discussions on the practical use of digital currencies internationally, and movements toward the practical use of CBDC (Central Bank Digital Currency) have been gaining momentum, particularly in China and Cambodia.

As electronic B/Ls and digital currencies (or crypto assets) become more widespread internationally, the potential for simultaneous exchange of digital data arises. For this reason, Tokio Marine & Nichido, NTT DATA, STANDAGE, and TradeWaltz jointly conducted a demonstration experiment to establish a new trade settlement system that realizes simultaneous exchange of digital currencies for electronic B/Ls.

* 1. Bill of Lading: A document of title that represents the right to receive delivery of goods from a carrier and also the ownership of goods.

2. Demonstration Experiment

(1) Outline:

Confirming that the simultaneous transfer of “B/L” digitized by the trade platform and “digital currency (or crypto assets)” is possible using blockchain technology.

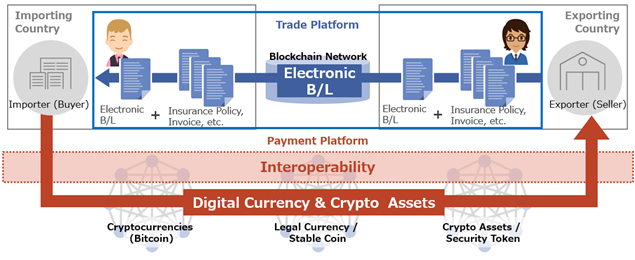

Simultaneous Exchange of Electronic B/L and Digital Currency (Crypto Assets)

NTT DATA provided a trading platform (TradeWaltz ® (* 2)) that digitizes B/Ls, insurance policies, invoices, etc., and interoperability technology (* 3) that links multiple blockchains, and STANDAGE provided technology for the transfer of crypto assets.

In addition, several companies including Matsuo Sangyo Co., Ltd. (https://www.matsuo-sangyo.co.jp/en/) and Will Be Co. Ltd. (https://willbecorp.com/) joined and cooperated in the verification of experiment, and provided concrete advices for its practical application.

They confirmed successful simultaneous transfer of electronic B/L and payment in digital currency through the demonstration experiment, which meant it became possible to create a completely new settlement system in trading arena.

* 2: Tokio Marine & Nichido News Release (October 27, 2020) “Cross-Industry Investment by Seven Enterprises in New TradeWaltz® Platform – Leveraging Blockchain Technology to Digitalize Trade and Strengthen Connectivity in Asia -”.

https://www.tokiomarine-nichido.co.jp/company/release/pdf/201027_01.pdf

* 3: A mechanism that enables information exchange between different blockchains.

(2) Demonstration period: Approximately 4 months (August 2021 to December 2021)

3. Expected Effect

Based on the results of the demonstration experiment, the following effects are expected:

(1) Eliminate risks of international trade

In traditional trade, there are risks that buyers cannot receive goods if they pay in advance, and sellers cannot receive payments if the shippment is in advance. Simultaneous exchange of electronic B/Ls and digital currencies (or crypto assets) will eliminate such risks.

(2) Reduce costs for importers and exporters

To avoid risks related to trade payments, a third party (banks, factoring companies, insurance companies, etc.) takes over the risks and receives a risk premium as consideration. If simultaneous exchange is possible, the risk premium will become unnecessary.

(3) Enhance trades among SMEs

Despite having technological capabilities and distinctive features, many SMEs have missed their opportunities to acquire new customers overseas because they cannot receive their payments in advance. The new system will solve such problems and stimulate trade among SMEs.

(4) Simplify trade procedures

Simultaneous exchange of rights and obligations clarifies the ownership and transfer of property, which resolves issues related to time lags.

The four companies on this project will take further steps toward establishing this world’s first system by the end of fiscal 2023, taking full advantage of the results of this experiment.

【Contact Us】

4F Shiba NA Building, 3-6-10, Shiba, Minato-ku, Tokyo, Japan, 105-0014

STANDAGE Inc.

CEO: Akinori Adachi

COO: Kenta Omori

E-mail: info@standage.org