2023.10.20

STANDAGE Releases Report on "Japanese Cultural Exports"

STANDAGE Co., Ltd. (Head office: Minato-ku, Tokyo, CEO: Akinori Adachi, hereinafter referred to as Standage), which operates the one-stop trade support service "DigiTrad", has released a report on "Japanese Cultural Exports".

■1|Current situation of Japanese small and medium-sized enterprises not making much progress in exports

With the domestic market expected to shrink due to a declining population and other factors, the number of small and medium-sized enterprises dealing in Japanese food ingredients aiming to enter overseas markets is increasing year by year. The government is also implementing various measures to increase exports, and in 2020 the Ministry of Agriculture, Forestry and Fisheries compiled the "Implementation Strategy for Expansion of Exports of Agricultural, Forestry and Fishery Products and Food," setting a goal of increasing the export value of agricultural, forestry and fishery products to 2 trillion yen by 2025 and 5 trillion yen by 2050. Thanks to these efforts, exports have been on a gradual upward trend, despite a temporary decline due to the COVID-19 pandemic.

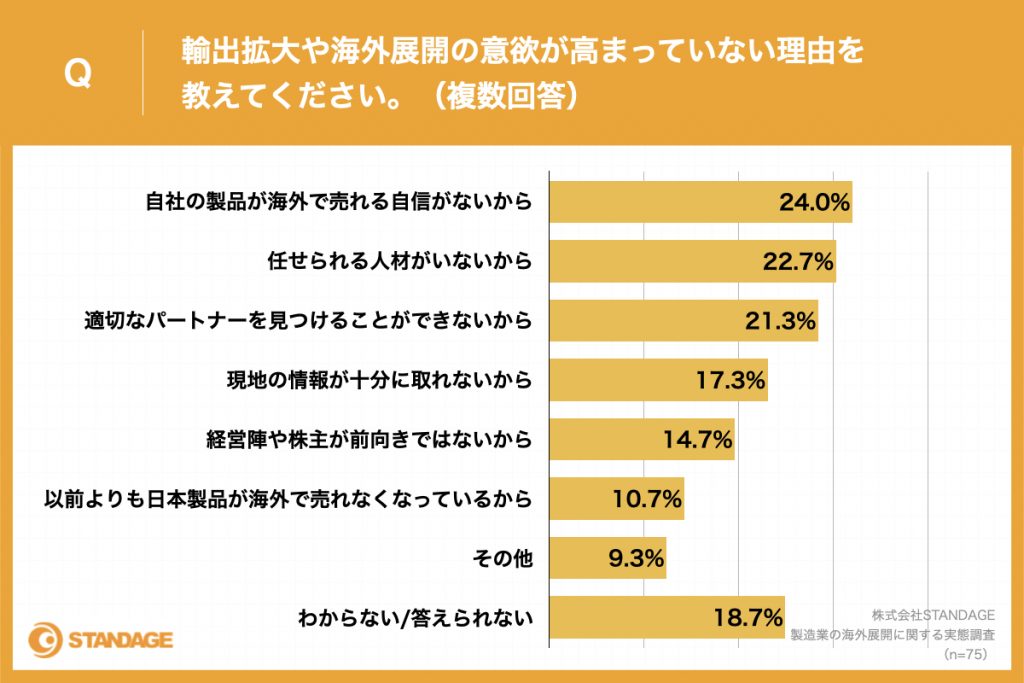

However, when looking at the export volume of small and medium-sized enterprises in urban and rural areas, the disparity is still widening. According to a survey*1 conducted by Standage targeting 100 managers and executives of small and medium-sized manufacturing companies (with 100 to 300 employees) that have not expanded overseas, only 18.01 TP3T companies have increased their desire to expand exports and expand overseas in response to recent trends such as the weak yen, high resource prices, and rising prices.

Reasons given for being reluctant/conservative about exports include "not being confident that our products will sell overseas" and "not having the personnel we can trust," which shows that there are high hurdles to expanding overseas.

■2 | Signs of a boom in "overseas exports" from Kanazawa City, Ishikawa Prefecture

In response to the current situation where exports by Japanese small and medium-sized enterprises are not progressing, Standage is providing trade support packages for small and medium-sized enterprises in order to contribute to regional revitalization throughout Japan. In particular, we are focusing on the Hokuriku region, and in 2022 we partnered with Hokuriku Bank to begin export support.

While promoting export support initiatives in the Hokuriku region, we have noticed a strong desire to export among young business owners in Kanazawa City, Ishikawa Prefecture. Local companies producing Kanazawa Bocha tea, frozen sushi, lacquerware, and more have stepped up to expand their overseas sales channels by using Standage's trade packages.

Kanazawa is an area with a strong inbound tourism base, and the Junior Chamber International (JCI) has a strong sense of unity. There is strong cooperation among business owners in their 40s and 50s who are considering business succession, and there is a strong desire to take on new challenges in the context of "From Kanazawa to the world."

■3 | What are the barriers to exporting from Hokuriku (Kanazawa)?

At the same time, issues have also come to light.

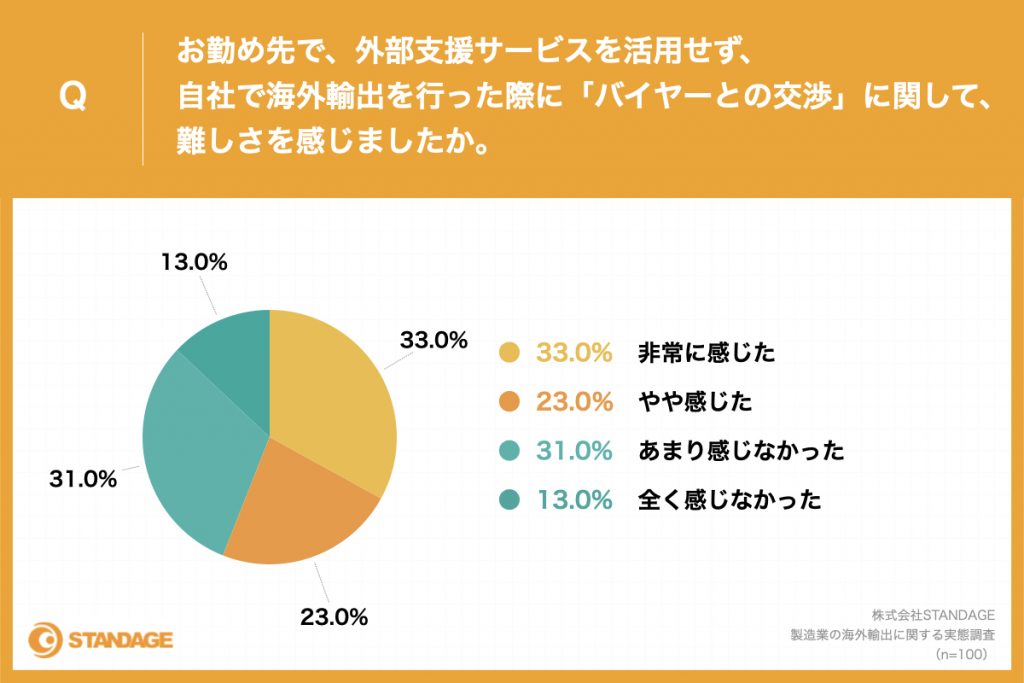

According to a survey*2 conducted by Standage targeting 100 managers and executives of small and medium-sized manufacturing companies (with 100-300 employees) who have experience exporting overseas at their own companies, more than half of the respondents found it difficult to export overseas at their own companies.

In addition to issues with logistics, such as quality control, and the difficulty of dealing with the buyers after matching, many also seem to be concerned about the rising costs and lack of human resources involved in overseas sales and logistics management.

In fact, although export volume across Japan has been gradually increasing, the export value and share from airports and ports in the four Hokuriku prefectures is not large, at 3.6 billion yen (0.3%) as of 2021.

Although Hokuriku has many specialty products that can be exported overseas, the region's characteristic of producing many small items is cited as the reason why exports have not increased. Exports of agricultural, forestry, and fishery products and food from the Hokuriku region require small-lot freight transport to ports and airports on the Pacific coast, which is a challenge unique to the Hokuriku region and different from that faced by major metropolitan areas with well-developed logistics systems.

■4|A "specialty product-focused" trade package service born from the export needs of Hokuriku sake breweries

To solve the above problems, Standage has developed a package plan specialized for exporting local specialty products. This plan is based on our package service "Digitrad", which handles all aspects of trade creation from market development to contracts, negotiations, settlements, and logistics in order to promote the entry of small and medium-sized enterprises into the export industry.

While following in the footsteps of Digitrad's functions and systems that allow for "complete" trade, we are able to reduce initial costs by limiting contracts to businesses that meet our criteria for "regional specialty products." We have also built a logistics network from scratch that will enable small-lot door-to-door transport by temperature-controlled air freight, a first in Japan, and are working on this as a project subsidized by the Ministry of Agriculture, Forestry and Fisheries.

The specialty product-focused trade package plan has been extremely well-received, and is currently being implemented by over 20 companies nationwide, most of which are sake breweries. This specialty product-focused service was born out of a need from sake breweries in the Hokuriku region, who had issues with quality control and batches when exporting. Sake is mainly sold to high-end restaurants and hotels in Europe, and this logistics network has attracted attention from companies in the Hokuriku region and throughout the country dealing in regional specialty products (seafood, vegetables, meat, etc.). It is particularly compatible with Hokuriku, which has a wealth of world-class seafood.

In May 2023, we held sake tasting events in Paris and London. Because we have partner companies in the area, we continue to follow up after the event and encourage continued orders and increased order volume. First, we plan to sell sake to restaurants overseas and establish an export route, and then distribute local specialty foods there as well, with the aim of delivering the flavors and food culture of Hokuriku and all of Japan to the world.

■5 | What is important to contribute to regional revitalization, learned through export support

Until now, if you wanted to "trade," you had to develop sales channels, negotiate with buyers, sign contracts, complete payment procedures, and even manage logistics.

If you try to tackle this in-house, you will incur costs such as securing personnel capable of overseas sales and preparing trade practice tools. It would be difficult for small and medium-sized enterprises with limited resources to handle trade practices and negotiate contracts with overseas companies on their own. If we take over that part of the process, about half of the cost can be covered by subsidies, and we will purchase some of the remaining half of the products domestically in advance, so you can start trading with less initial outlay and peace of mind.

Rather than just selling the products of individual companies, especially in the case of specialty products, if you export the concept as a "culture," "technology," or "specialty" unique to Japan or a region, it will be possible for the product to be properly recognized overseas, and domestic companies that are the sellers will be able to send their products overseas with confidence and peace of mind.

We hear from many small and medium-sized enterprises that even when they receive inquiries from overseas buyers thanks to support from the government and other organizations, they don't know how to respond.

The same survey*2 also revealed that 56.0% companies found it difficult to "negotiate with buyers" when exporting overseas on their own.

To support exports as a continuous business, it is important not to just introduce buyers and then end the process, but to also take care of follow-ups such as overseas local sales and further promotion after an inquiry has been made, and to provide support and accompany the company on a broad scale rather than a point-by-point basis. Going forward, we would like to continue to see things from the perspective of companies that are bearers of culture and technology, consider forms of support that meet their needs, and continue our efforts that will also lead to regional revitalization.

*1 Survey overview: Survey on the actual situation regarding overseas expansion of manufacturing industries

Survey method: Online survey

Survey period: September 27, 2023 to October 3, 2023

Valid responses: 100 managers and executives of small and medium-sized manufacturing companies (with 100 to 300 employees) that have not expanded overseas

*2 Survey overview: Survey on the status of overseas exports in the manufacturing industry

Survey method: Online survey

Survey period: September 28, 2023 to October 11, 2023

Valid responses: 100 managers and executives of small and medium-sized manufacturing companies (with 100-300 employees) who have experience exporting overseas (without using external support services)

■About the "DigiTrad" trading package plan

"DigiTrad" is a comprehensive trade package service developed exclusively by Standage that provides a one-stop service covering everything from sales channel development to negotiations, contracts, settlements, and administrative procedures related to logistics and customs clearance.

Due to the rapid depreciation of the yen in the second half of 2010 and the government's efforts to expand exports, Japan's overall export volume has been on a gradual upward trend. However, when looking at the export volume of small and medium-sized enterprises in urban and rural areas, the gap is still widening.

Digitrad was created as a package service to handle all aspects of trade, from market development to contracts, negotiations, payments, and logistics, to enable Japanese manufacturers, who face these challenges, to expand overseas more freely and easily.

Rather than being limited to systematizing some operations or providing consulting, this is a service that can "handle" the entire flow of trade. As of the end of August 2011, the number of companies that have adopted this service has reached a total of 100.

(For more information, click here:https://boueki.standage.co.jp/digitrad/)

■About STANDAGE

Founded in March 2017. With a vision of "creating a world where all countries have equal access to all goods," the company is developing a new trade settlement system that utilizes blockchain to enable the safe, secure, and inexpensive simultaneous exchange of "goods" and "money" regardless of region or country. The company sees its main market as emerging countries, especially in Africa, and has established bases in four African countries, including Nigeria, to carry out trade business with Africa. It is not limited to the trade settlement field; it develops and provides systems that realize digital transformation for the entire trade system, including market development, ordering, and international logistics, while also working to support exports by small and medium-sized enterprises in order to increase the number of new domestic trade players.

Company name: STANDAGE Co., Ltd.

Established: March 2017

Representative: President and CEO Akinori Adachi

Capital: 608,568,500 yen (including capital reserve of 302,782,500 yen)

For trade-related inquiries, please contact us here.